In the opening quarter of 2023, Japan's mobile app revenue surged to an impressive $4.65 billion, reflecting a remarkable 13% growth from the previous quarter. This substantial rise showcased the financial prowess of Japan's mobile market, a testament to its ongoing expansion and innovation.

Mobile market revenue

The Japanese gaming market in 2023 has emerged as a dynamic force, replete with trends and statistics that shed light on its vibrant nature.

Impressive Expenditure Projection: Japanese residents are poised to contribute a substantial $12.6 billion to mobile gaming in 2023, emphasizing the nation's unwavering commitment to digital entertainment.

Quarterly Growth Surge: The first quarter of 2023 witnessed a remarkable $3.41 billion spent on games, reflecting a substantial 13% increase from Q4 2022. This robust growth mirrors broader app trends, highlighting the interconnectedness of mobile experiences.

Genre Dynamics: Hyper-casual games and the Simulation genre stood out with their robust recoveries, boasting growth rates of 56% and 30% respectively, quarter-on-quarter. This underscores the diverse appeal of different gaming categories.

Global High-Paying Gamers: Japanese gamers have positioned themselves as some of the world's highest-paying players. On average, an iOS user invests $10.3 per month, securing the first-place position globally, while Android users closely follow with a monthly expenditure of $9.8.

Mobile Game Downloads in Japan

The landscape of mobile game downloads in Japan during 2023 offers insightful trends and statistics that shape the nation's digital gaming journey.

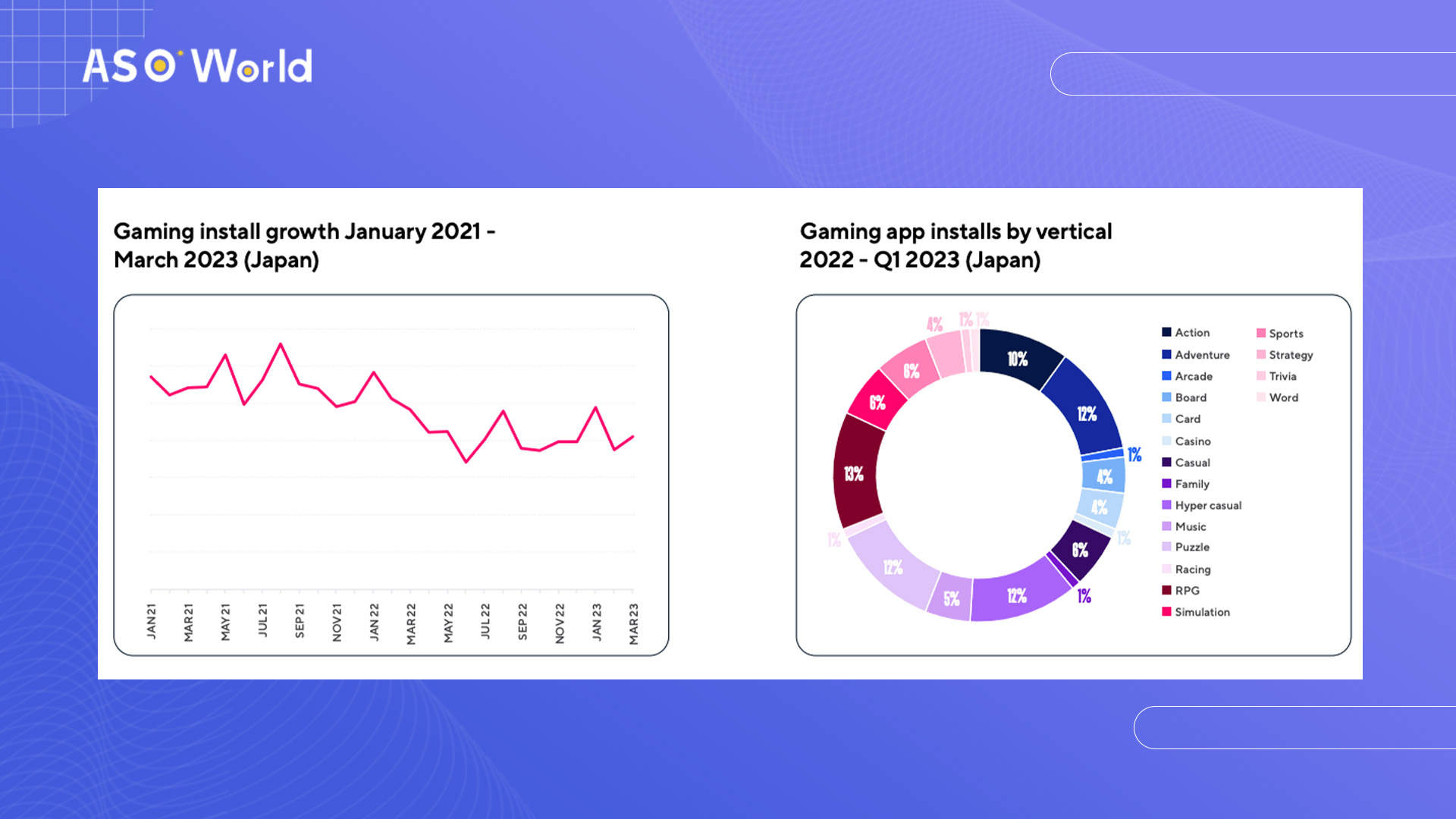

Resilient Growth Trajectory: The first quarter of 2023 witnessed a substantial 12% surge in mobile game downloads, outpacing the market average by an impressive 3 percentage points. This robust growth reflects Japan's vibrant digital gaming landscape.

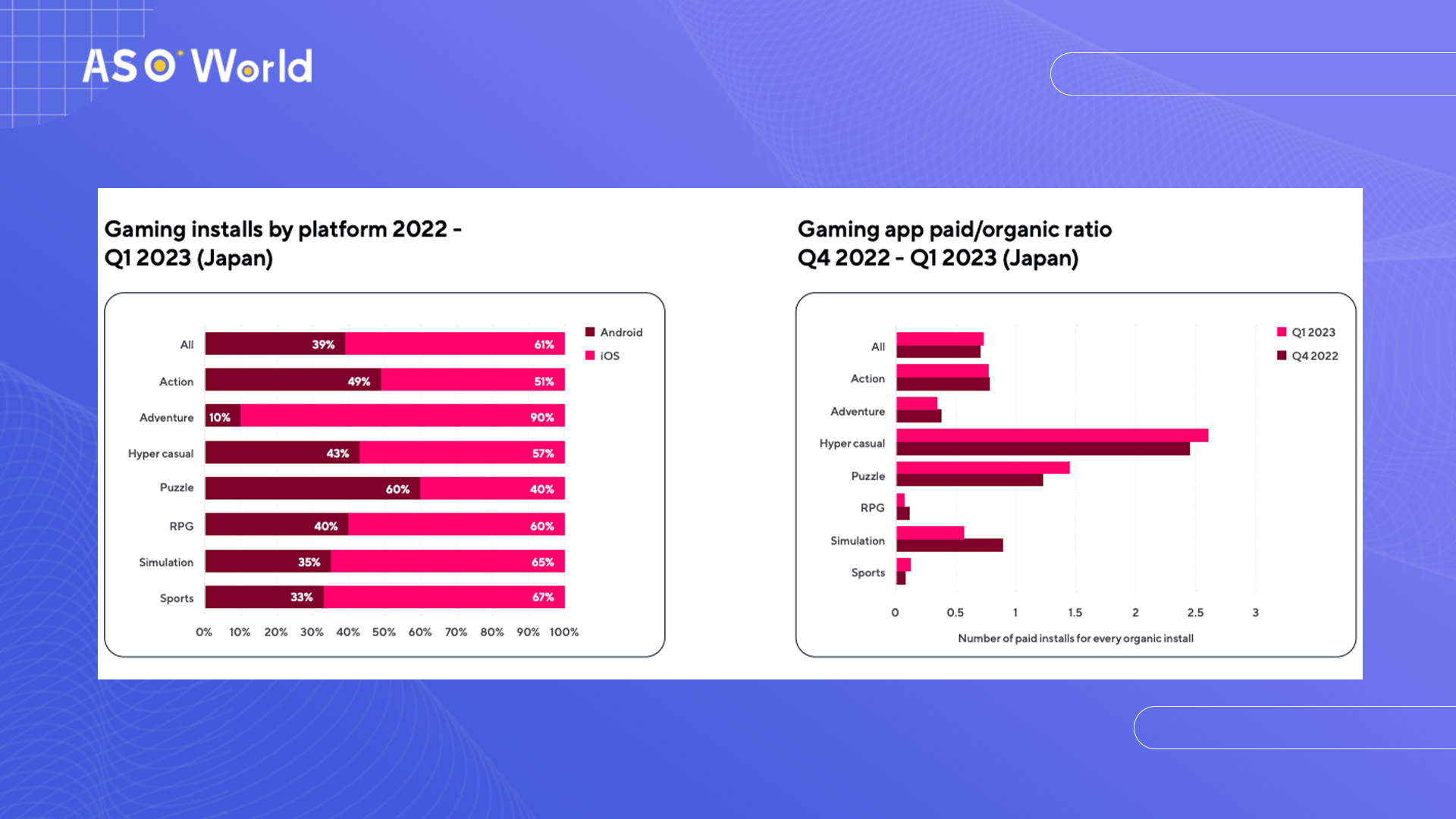

Platform Division: The distribution of downloads between Android and iOS platforms unveils a unique pattern, with Android accounting for 39% and iOS dominating with 61%. This distinctive division positions Japan as one of the select global markets with such a configuration.

Evolving User Acquisition: The report spotlights a decline in organic traffic during Q1 2023. The ratio of paid traffic to organic traffic decreased from 0.73 to 0.7 on average across genres, reflecting the dynamic shift in user acquisition strategies within the Japanese gaming market.

Genre Preference: Role-Playing Games (RPGs) emerge as the clear favorite among gamers in Japan, commanding a significant 13% of all downloads. This genre's enduring appeal underscores its resonance within the local gaming community.

User Engagement in Mobile Games

A closer examination of user behavior within the realm of mobile games in Japan during the first quarter of 2023 reveals intriguing patterns and dynamics.

Here are the key insights to be gleaned:

Retention Patterns: Through the initial quarter of 2023, user retention patterns showcased the following figures: Median D1 Retention stood at 27%, D3 Retention at 18%, D7 Retention at 12%, and D30 Retention at 5%. These retention rates offer a comprehensive understanding of user engagement over time.

Genre-Specific Retention: Role-Playing Games (RPGs) emerged as front-runners in user retention. Notably, RPGs achieved the highest D1 Retention rate at 32%. Following closely, Simulation games and puzzle games secured commendable rates of 30% and 28% respectively.

Session Dynamics: The first quarter of 2023 witnessed a noteworthy 6% surge in the number of gaming sessions compared to the previous quarter. Although positive, this growth trajectory slightly lagged by 3 percentage points behind the market average, signifying nuanced trends within user engagement.

Platform Contribution: Platform-specific user engagement revealed Android accounting for 33% of all sessions in Q1 2023, while iOS dominated with a notable 67%. This platform disparity underscores the preferences and habits of the gaming audience across different devices.

Session Duration: An intriguing trend emerged in session length, with total session duration on a steady rise since 2021. As of now, the session length has reached an impressive 26.59 minutes, underscoring the immersive and engaging nature of mobile gaming experiences.

Mobile Gaming Audience in Japan

The mobile gaming audience in Japan presents a vibrant and diverse landscape, marked by intriguing statistics and preferences that offer valuable insights into the nation's digital entertainment habits.

Here are the key aspects that define this dynamic audience:

Magnitude of Mobile Gamers: Japan has established itself as a stronghold for mobile gaming, boasting a substantial community of approximately 70 million mobile gamers. This staggering figure positions Japan as one of the world's largest and most influential gaming markets.

Daily Engagement: A remarkable 65% of smartphone owners in Japan actively engage in mobile gaming every single day. This consistent daily interaction underscores the integral role that gaming plays in the daily lives of a significant portion of the population.

Weekly Play Consistency: The allure of mobile gaming is widespread, with an impressive 92% of smartphone owners participating in gaming activities at least once a week. This high percentage reflects the broad appeal of mobile games across different demographics.

Generational Gaming Preferences: Gaming preferences exhibit intriguing generational variations. Generation Z's inclination towards Party Royale is striking, with a notable 233% higher likelihood to choose this genre. Younger Millennials exhibit a 52% greater likelihood to opt for MOBAs.

On the other hand, puzzles resonate most with older Millennials. Furthermore, Generation X and baby boomers display a distinct preference, dedicating 42% more time to playing card games than their counterparts.

Web3 Gaming Success in Japan

In the pursuit of conquering the Japanese mobile gaming landscape, Web3 game studios must adopt targeted strategies. Here are the key takeaways to guide this endeavor:

Massive Opportunity: Japan's expansive mobile gaming market demands attention due to its substantial size and rising app usage trends.

Personalization is Paramount: Tailoring strategies based on user preferences and demographics enhances resonance, ensuring effective engagement across different age groups and genders.

Cultural Integration: Infusing games with Japanese culture and preferences holds the winning formula. Games reflecting local habits can create a strong bond between the audience and the game.

Engagement Amplification: Understanding Japan's gaming preferences allows developers to craft immersive experiences that resonate. Harmonizing with user interests paves the way for standout games in a competitive market.

Elevated Success Prospects: By aligning with Japanese gaming habits, Web3 game studios can significantly enhance their odds of success. Incorporating features that cater to local tastes can drive a stronger impact.