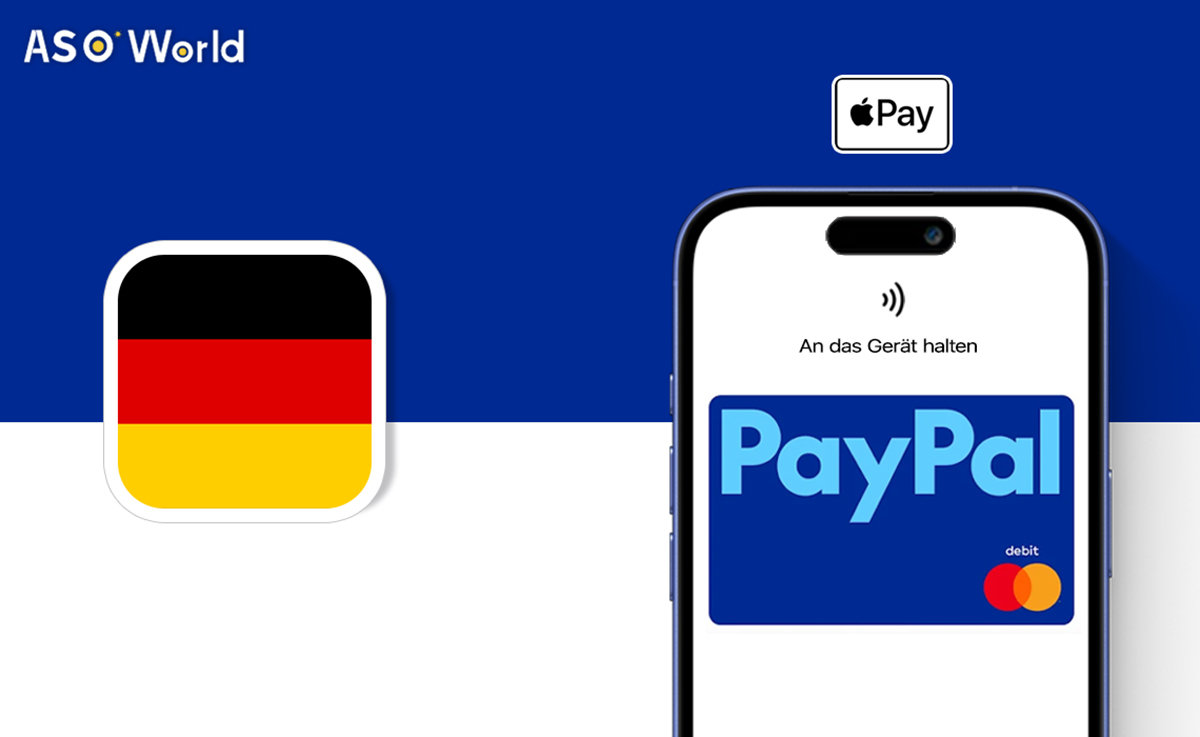

PayPal has launched a new feature allowing iPhone users in Germany to make contactless payments using the PayPal app.

This development follows recent European Union regulations that require Apple to open its Near-Field Communication (NFC) technology to third-party providers, thereby fostering competition and offering consumers more choices in mobile payments.

Background and Regulatory Context

The European Union's Digital Markets Act (DMA) aims to ensure fair competition in digital markets by preventing dominant tech companies from restricting access to essential technologies.

Prior to the DMA, Apple limited the use of the iPhone's NFC chip to its own Apple Pay service.

In July 2024, after a four-year antitrust investigation, the European Commission accepted Apple's commitments to open its tap-and-go mobile payments system to competitors, making these commitments legally binding for ten years.

This decision allows developers to access the NFC functionality on iOS devices, enabling them to offer their own contactless payment solutions.

How the PayPal NFC Payment Feature Works

With this new feature, German iPhone users can set PayPal as their default payment app.

To make a payment, users can double-press the side button on their iPhone at any store that accepts Mastercard contactless payments.

Alternatively, they can open the PayPal app to complete the transaction.

This process mirrors the convenience of Apple Pay but provides users with an alternative payment option.

(Credit: Paypal)

Benefits and Market Impact

The introduction of PayPal's NFC payment feature offers several advantages to consumers:

- Potential Rewards: PayPal may offer cashback rewards and financing options, providing additional incentives for users.

- Enhanced Competition: By challenging Apple Pay's dominance, this development encourages competition, which could lead to better services and innovations in the mobile payment sector.

Editor's Comments

PayPal's launch of NFC payments for iPhone users in Germany marks a significant milestone in the evolution of mobile payments.

This move not only aligns with the European Union's efforts to promote competition but also sets a precedent for other regions considering similar regulatory measures.

As more third-party providers enter the market, consumers can expect a broader range of payment options and potentially more favorable terms.

However, it remains to be seen how Apple and other tech giants will adapt to this changing landscape and what further innovations will emerge as a result.